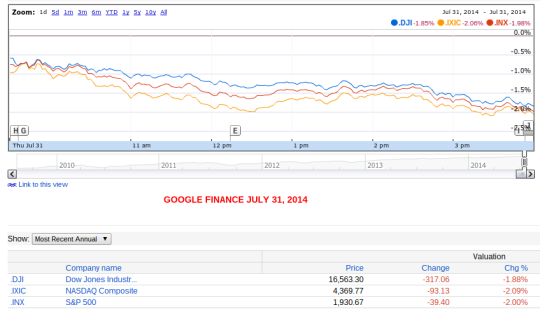

The stock market had a rough ride for the last day of July. The major indexes were all impacting with a 2.0% loss by the close of trading on Thursday. Why the sharp sell off by investors? The market was due for a correction, and 4 concerns were the pressure for investors to sell and realize gains while the pressures are risks to the market. Here are the 4 reasons stocks fell sharply on Thursday….

1) Argentina‘s second default in 13 years did not bode well for the market. The second default is not the same worst case scenario as the default in 2001. Negotiations are ongoing in making some compromise between Argentina and the country’s creditors including US Hedge Funds to still reach a deal. The country is experiencing a recession, but it is unlike the deep recession of 2001-2002. This recession will not cripple the country to find a solution in this latest crisis, but this is one of two major geopolitical concerns weighing on investors and the markets.

2) Russia sanctions are another geopolitical concern. The sanctions are intended to punish Russia, but investors are in the mindset the real punishment in harsher sanctions will be the European economy. The situation is so volatile, and energy is so important to Europe in access to Russian oil and natural gas.This is another concern to investors.

3) The Federal Reserve is on the verge of pull back on the liquidity and interest rate environment that has allowed plenty of cash and low interest rates to benefit the banking industry and the markets The Feds are at the point to pull the liquidity out of the market, and begin the rise in rates which will impact banks in paying more for deposits and spark an interest rate competition for deposits to save an outflow of money from the banks when rates rise. Cheap money is ending, and the Fed speaks. Investors will react.

4) Earnings are another issue for investors. Quarterly earnings were a disappointment for many large companies including Exon Mobile and Whole Foods to add to investor fears to produce a sharp sell off as experienced on Thursday.

Thursday was the worst day for the Dow, NASDAQ, and S&P in six months. The jobs report will be released later this morning, and the report will impact on market’s reaction on this First Friday in August.

August 1, 2014

Current News Event, Donny Wise Live in Personal Finance, Examiner.com - Consumer and Finance, Examiner.com- DC Consumer and Banking Examiner, PERSONAL FINANCE NEWS, WISEME ARCHIVE